Alright, folks, here we go again. Gold’s acting like it wants to be taken seriously — but plot twist: it’s still wearing clown shoes.

Let’s break down what happened last week (July 7–11), shall we?

Weekly Candle Recap: “So Close, Yet So… Gold”

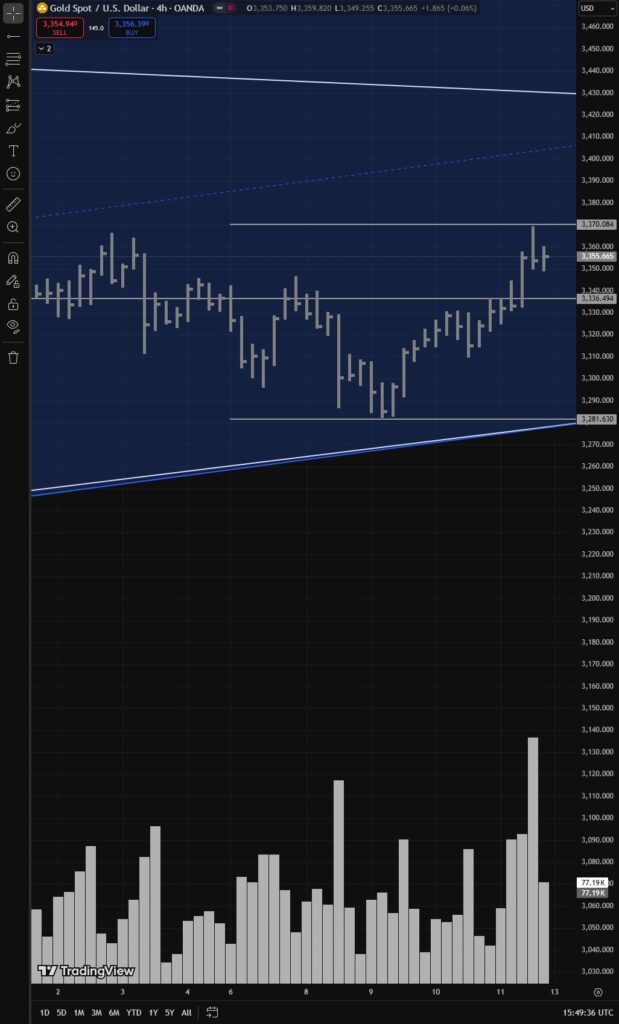

Gold strutted all the way up to 3370, flexed for the cameras… and then chickened out and gave us a 3355 close. High drama, low conviction.

Low of the week? 3281

High of the week? 3370

Final close? 3355

Volume? Oh look — it’s alive this time! Higher than last week. Great effort, right?

Well… not quite.

Effort vs Result — A Gym Bro Lifting Air

Yes, there was effort — price huffed and puffed, trying to break the previous high at 3367… but let’s be honest. It was all for show. It touched the ceiling at 3370 and immediately sat back down like it forgot why it even got up in the first place.

This wasn’t a breakout. This was a Fakeout with extra cheese.

You know the type — strong open, dramatic high, and then slouches home like it just got dumped.

Still Not Buying It: 3370 Is the Sellers’ Last Line of Defense

And yes, in case you forgot — 3370 was, is, and remains the final boss level for bulls. Until Gold breaks it cleanly and closes above it like it actually means it — I’m not falling for its sweet little green candles.

I said this in the last article and I’ll say it again:

No 3370 breakout = no bull party. Just more bear hugs.

Downside Targets — Where the Bears Might Mingle

So if Gold starts dropping from 3355, here’s the first trap door:

3336–3330 — a potential demand zone (aka, maybe someone’s interested here).

If that breaks down? Well well well…

3281 is wide open.

In fact, between 3330 and 3281, it’s like a red carpet laid out for sellers.

Daily Chart Says:

We might be looking at a cute little RBS (Resistance Becomes Support) zone around 3347–3330. But remember: cute zones get trampled if volume’s in the mood.

Also — while we technically printed a higher low at 3281, we still haven’t broken the previous Lower High (3367). I mean it did at 3370 but it appeared more of a Fakeout then a Breakout, so let’s not pop champagne yet.

UHV + Supply at 3370 = Fakeout Confirmed?

Oh, and let’s not ignore Friday’s drama:

- Candle touched 3370

- Volume? Ultra High

- Closing? Back down at 3355

- Result? Rejected faster than a bad Tinder pickup line.

So yeah, we had a high-volume rejection, and until I see otherwise, I’m slapping a “FAKEOUT” sticker on that 3370 drama.

H4 Timeframe: Upthrust & No Demand — Gold’s Signature Move

If the weekly was messy, H4 is spilling tea.

- Candle that touched 3370? Upthrust.

- Candle after? No Demand with decreasing volume.

- Translation? Gold knocked but no one answered.

The key H4 demand zone? 3347–3330

Break that, and next stop is the 3300–3281 support bus stop.

Conclusion: Don’t Get Catfished by a Green Candle

So what am I doing? Shorting the drama.

As long as Gold doesn’t confidently break 3370 and look good doing it — I’m only looking for short entries.

Only when 3370 says “I do” with volume and conviction, I’ll consider the bulls. Until then? It’s all noise.

TL;DR — XAUUSD Analysis at a Glance

📆 Weekly Timeframe:

- Price Action: Gold reached 3370 but failed to close above it (3355 close).

- Effort vs Result: UHV breakout attempt failed — classic Fakeout, not Breakout.

- Key Resistance: 3370 = ultimate line in the sand.

- Bias: Still Bearish until 3370 breaks with conviction.

- Downside Targets:

- First: 3336–3330 (possible demand)

- If that fails: 3281 is back on the menu.

📉 Daily Timeframe:

- Structure: Printed a Higher Low at 3281, but still stuck below Lower High (3367/3370).

- Volume Check: Friday candle = UHV rejection from 3370 — confirms supply presence.

- Support Zone to Watch:

- 3347–3330 (possible RBS zone)

- Break below it? Next stop: 3301–3281

⏱ H4 Timeframe:

- VSA Signals:

- Upthrust at 3370

- Followed by classic No Demand

- Interpretation: Gold made a scene at 3370, but no one bought the drama.

- Support Zone:

- 3347–3330 = key demand area

- Break that? 3300–3281 is the next stop

Disclaimer (a.k.a The Fine Print That Saves Me From Lawsuits):

This is not financial advice. This is sarcastic commentary from a caffeine-infused chart whisperer who reads candlesticks like they’re dating profiles.

If you make money — great! Send biryani. If you lose money — you probably married a breakout that wasn’t loyal.

Stop trading like you’re in a Netflix rom-com. Structure is still bearish. Respect it.

And remember:

“Just because it closed green doesn’t mean it’s not toxic.” Stay smart. Stay safe. Stay sarcastic.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.