Structure’s still flexing, but Monday might just bring a bounce.

Alright gold fam — if you’re looking for the bigger picture, hit the following link for the full weekly analysis covering July 28 to August 1.

But if you’re only planning to dance in and out of the market on Monday, July 28, this one’s for you.

So let’s get into it.

Friday Recap (A Sneaky Candle with a Soft Landing)

- High: 3374

- Low: 3324

- Close: 3337

- Volume: Lower than the previous 4 daily candles

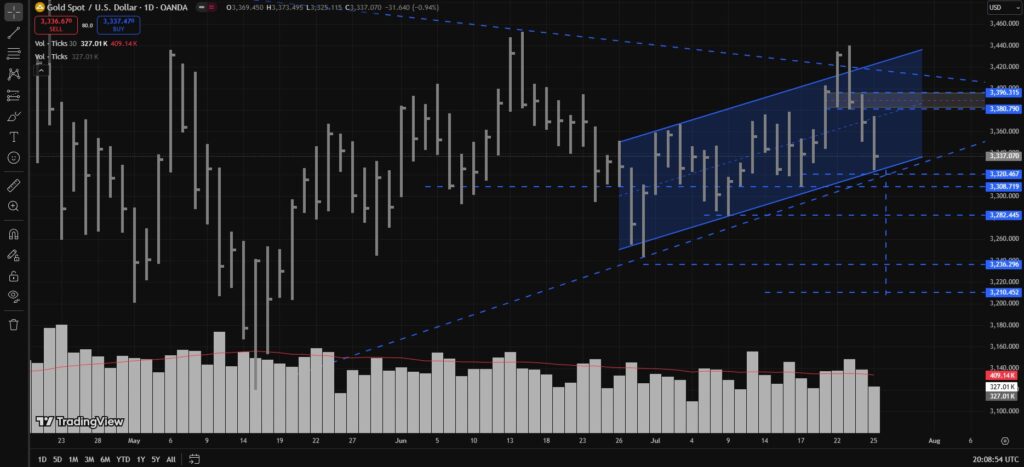

Now even though Friday’s candle closed bearish, the momentum has been bullish since June 30, and to this day, not a single Higher Low has been broken bearishly.

Translation? Structure = still bullish. Our most recent HL is sitting at 3308, and as long as that holds, we look for buys — not breakdowns.

H1 Order Block Watch

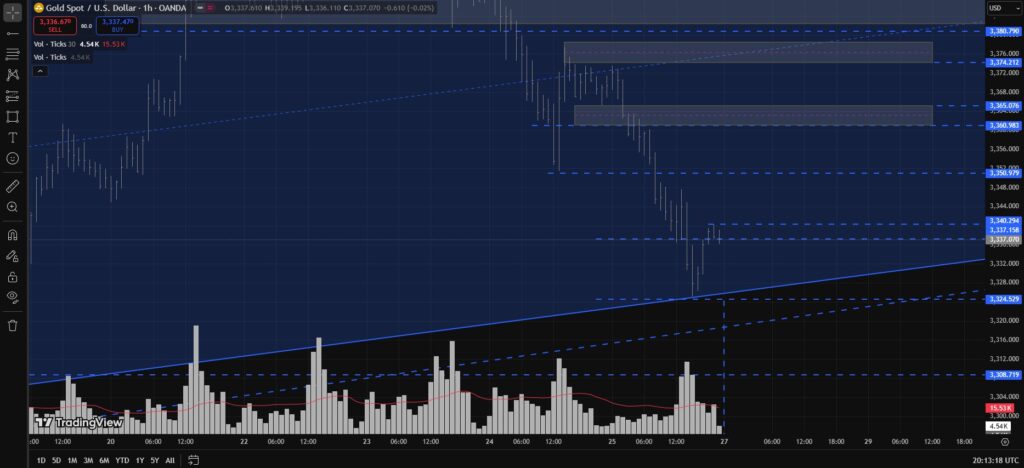

Zoom into the H1 chart, and you’ll see that the 3328–3308 order block has already been tested.

On Friday, price dipped to 3324, then bounced straight to 3340, closing the day at 3337.

So once again:

As long as 3308 doesn’t break down, we’re hunting bullish setups for Monday, July 28.

If 3308 breaks bearishly, this analysis is invalid.

Bullish Intraday Scenario – SOS Time?

Here’s the bullish case:

- Friday’s low-volume candle could be a Potential No Supply.

- The lower trendline of the bullish channel was tested.

- Another major trendline is sitting around 3320–3315.

So if, after the Monday open, Gold accumulates near 3324, 3315, or even dips to 3308 — and shows SOS (Signs of Strength) — we’re looking to buy.

What’s SOS in simple words?

It’s when price starts printing Higher Highs and Higher Lows, maybe dips below trendlines temporarily, but closes strong above key levels — like 3324.

Think of it as the market pretending to be weak, then pulling off a glow-up candle.

Key SOS Zones to Watch:

- 3324

- 3315

- 3308 (or even a dramatic sweep to 3300, as long as we close back above)

If price shows strength from these areas, here are the targets:

- 3340 – First intraday resistance

- 3350 – Minor SBR level

- 3360–3365 – Strong SBR zone

- 3374-3378 – Previous high retest

Above 3374-3378, we head straight into the weekly FIB zone at 3380–3395, which is where we expect major Supply to kick in.

If that breaks? Check the full weekly analysis for the spicy breakout targets. The link can be found at the start/intro of this analysis.

TL;DR:

- Structure still bullish above 3308.

- Friday’s low-volume = Potential No Supply.

- Watching 3324–3308 for bullish setups.

- Intraday Targets: 3340 – 3350 – 3365 – 3378.

- Look for SOS (Signs of Strength) — higher closes after sweeps.

- 3380–3395 = Key supply zone to watch for rejections.

Disclaimer:

This isn’t financial advice — it’s just educated candle gossip.

If it works out, buy me coffee.

If it doesn’t, blame the liquidity sweep — not your cousin who sent you this analysis.

Stay sharp. Use a stop-loss. And stop treating every green candle like it’s a soulmate. Happy trading!

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.