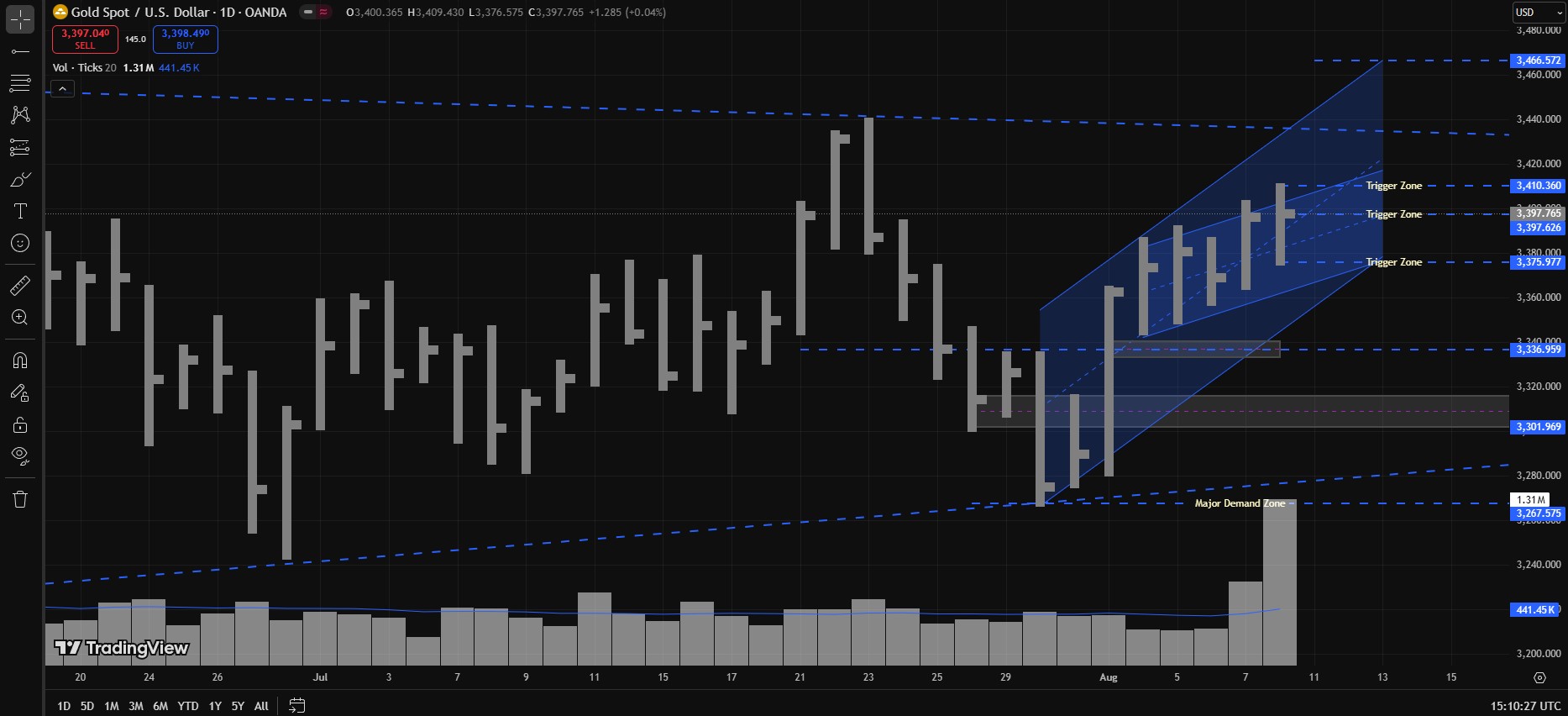

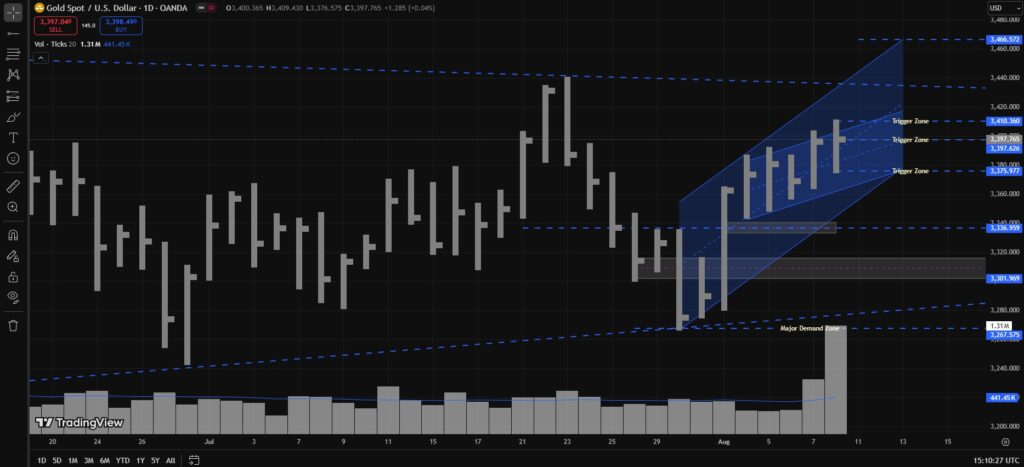

Alright folks, here’s the update for the upcoming week from August 11 to August 15, 2025 for Gold (XAUUSD).

Friday, August 8, 2025’s daily closing for XAUUSD (aka Gold) was yet another narrow spread bar with Ultra High Volume (UHV) — in fact, the volume was double the size of Thursday’s volume. Technically, the market closed up compared to August 7’s daily bar, but once again failed to break out above the 3400 level. It was just another upper wick rejection, ending the day below 3400.

Friday’s stats:

- High: 3410

- Low: 3375

- Close: 3397

- Volume: Double Thursday’s — a level not seen on OANDA’s daily chart since somewhere back in 2022.

The price action was essentially a tug of war between buyers and sellers. To me, this once again screams: “Smart Money selling heavily into the hands of retail buyers (the herd).”

However, Monday’s daily closing will be the real confirmation — whether Smart Money was Absorbing Supply or whether this was a Buying Climax.

Possible Scenarios:

- If it was Absorption:

Price could test 3375, bounce around that area, and head back up. - If it was a Buying Climax:

Price could break down through the 3375 low, then target 3360–3350, 3340–3330, and potentially 3316–3301.

Trendline & Weekly Projection:

Based on trendline analysis, next week’s potential range (August 11–15, 2025) is:

- High: 3466

- Low: 3375

Trigger Lines:

- High of Friday: 3410

- Low of Friday: 3375

- Closing price of Friday: 3397

Trading Logic for Next Week:

- Bullish Breakout Case:

If after Monday’s open, price breaks above 3410 on the 30M or 1H chart, the target is 3430–3440.

If 3440 breaks – 3466 would be the next target. - Bearish Continuation Case:

If price stays below 3397, low of Friday aka 3375 would be the possible target.

If bearish breakout takes place at 3375, next targets: 3360–3350, 3340–3330, and 3316–3301.

Bias & Market Structure:

The overall structure has been bullish since August 1.

However, after Friday’s price action and volume, until 3410 breaks upward, my bias remains bearish.

I had a bearish bias even on Thursday, saying that if the market wanted to go higher, it would need more volume than Thursday — and while Friday’s volume was double, price still failed to close above 3400.

So for now:

- Structure: Bullish

- Bias: Bearish

- Friday’s bar: Climactic Action

- Trigger Levels: 3410 – 3397 – 3375

TL;DR:

- Structure = bullish since Aug 1, but Friday’s UHV Narrow Spread = possible Buying Climax.

- As long as 3410 holds, Bias = Bearish.

- Break above 3410 = possible 3466 target.

- Break below 3375 = possible drop toward 3340 and even 3316.

Disclaimer:

This is not financial advice. If you follow this analysis and make money — send me coffee. If you follow this and blow your account — send me biryani. I’ll need comfort food too. Trade safe, respect your stop-loss like you respect your mom, and don’t chase every shiny candle like it’s your soul mate.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.