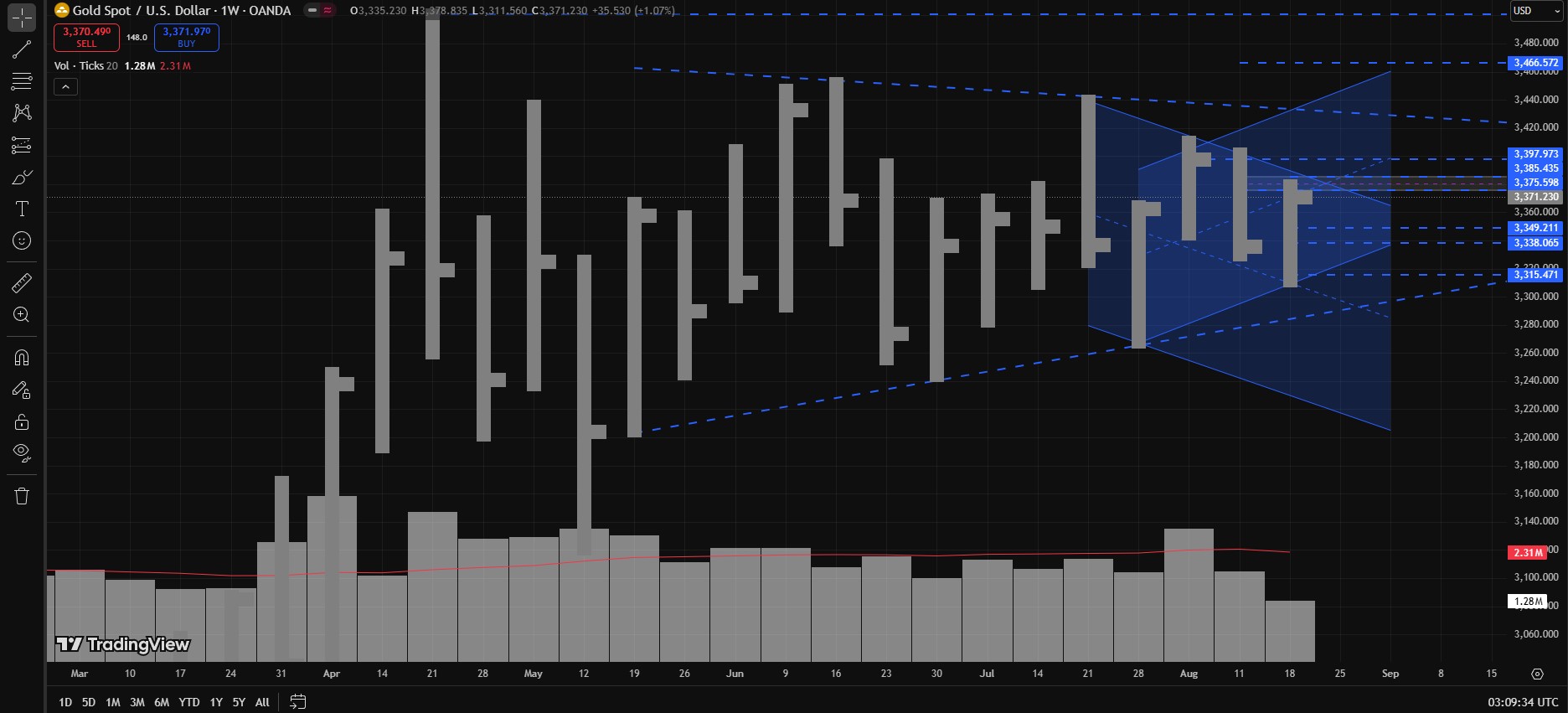

Alright folks, as you know, the previous week (August 18–22) for XAUUSD aka Gold has closed on Friday, August 22. During that week, Gold hit a low of 3311, a high of 3379, and finally closed the week at 3371.

This weekly bar turned out to be a strong up-close bar, but here’s the catch: volume was lower than the previous 32 weekly bars (OANDA chart). That basically makes it a Low Effort vs High Result bar.

Now if we step back to the background: it was still bearish. Since August 11, 2025, Gold has been making Lower Lows and Lower Highs. That’s why this up-close looks more like a Test bar, rather than strong demand.

And remember that important level I mentioned last week, 3365–3375? Well, Gold closed the week right inside that zone at 3371. Which means our previous week’s analysis is still intact, and the bearish bias remains unchanged.

Daily Timeframe Recap

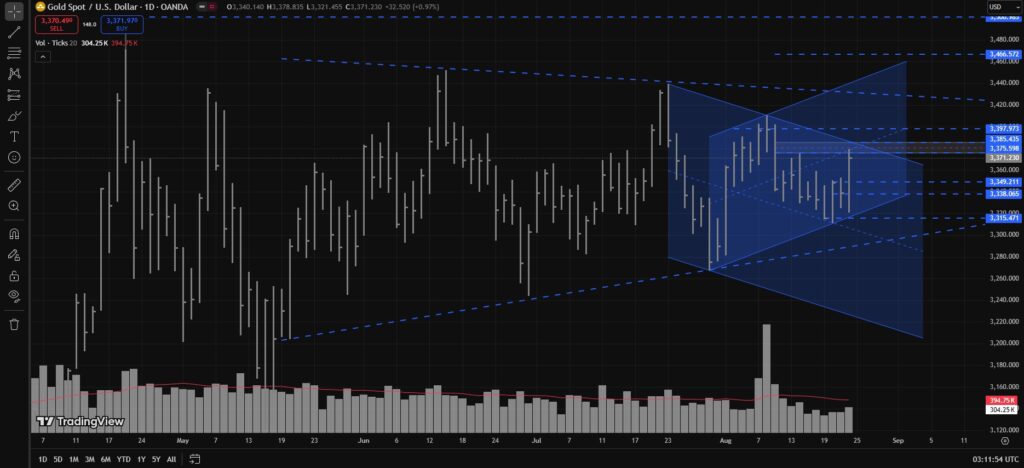

- After the No Supply bar on August 19, demand started to show up from August 20.

- Finally, on Friday, August 22, Gold printed a wide spread up move, closing at 3371 with a high of 3379 and low of 3321.

- Volume was higher than the last 5 daily bars, but still well below the 30-day average (MA30).

- On that same day, Gold also tested the August 8 UHV Daily Bar’s Low (Lower Trigger Line). After faking out at 3379, it still closed back at 3371.

What’s Next?

Now the real question: what’s next week’s play?

Since 3375 hasn’t been broken, the bias is still bearish. But I’m making a slight adjustment: our level is now 3375–3385. Why? Because:

- On the Daily timeframe, the trigger line sits around 3375–3376.

- On the H4 timeframe, the same line aligns closer to 3381.

- On the H1 timeframe, it sits at 3385.

So basically, for Gold to break our supply zone and flip bullish, it needs a clean breakout above 3385. Until then, 3375–3385 = Bearish Supply Zone.

Looking at trendlines and channels:

The July 23, 2025 Bearish Channel is still intact. Price closed near the upper trendline, which means – if Gold is truly bearish, it must not break 3383–3385.

Also note: a bullish structure is forming. If you draw a channel from the July 30, 2025 low > August 20, 2025 low > August 8 UHV Bar high, you’ll see the immediate bullish range Gold might move into if 3385 breaks.

Bearish Targets (if 3375–3385 holds)

If Gold rejects from the 3375–3385 supply zone, then:

- 1st Target: 3355–3350

- 2nd Target: 3335–3330

- 3rd Target: 3315–3310

- 4th Target: 3300–3290

- And more if bearish momentum kicks in.

Bullish Targets (if 3385 breaks cleanly)

If our bearish scenario fails and Gold breaks 3385 with strength, then bullish momentum could take it toward:

- 1st Target: 3397–3400

- 2nd Target: 3410–3415

- 3rd Target: 3425–3430

- 4th Target: 3440–3450

- And more if momentum continues.

TL;DR

- Weekly Closed at: 3371 (High 3379, Low 3311).

- Weekly Bar: Up close, but Low Effort vs High Result, however weak demand because it failed to breakout 3375. (Edited)

- Key Supply Zone: 3375–3385 > bias bearish until clean breakout.

- Bearish Channel (July 23rd, 2025) still intact – market price closed near its Upper Trendline.

- Bearish Targets – 3355 > 3330 > 3310 > 3300.

- Bullish Targets – Only above 3385 > 3400 > 3415 > 3430 > 3450.

Disclaimer

This is not financial advice – just me documenting my chart mood swings. If you profit, send me coffee. If you blow your account, send me biryani – because honestly, I’ll need comfort food too. Remember, respect your stop-loss like you respect your mother, and don’t chase every shiny Bar or Candle like it’s your soulmate.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.