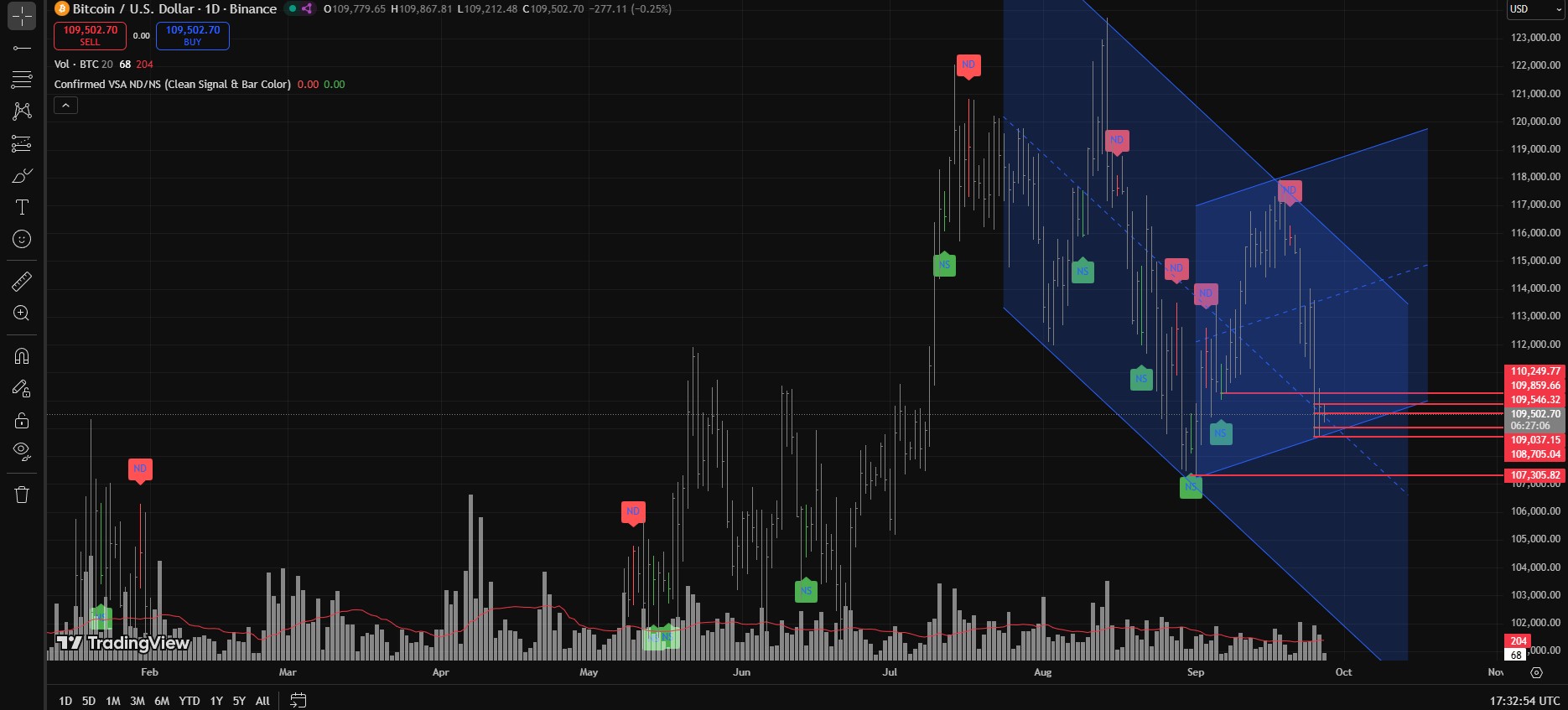

Alright folks, here’s the situation: Since the Highest High on August 14th, 2025, BTCUSD has been moving inside a bearish channel. Today is September 27th, 2025.

As of now, BTCUSD is trading around 109,859 with volume lower than the previous 5 bars. It looks like BTCUSD is testing supply after the September 25th wide spread down bar with ultra-high volume (UHV), which was followed by a small automatic rally (AR) on lower volume compared to the September 25th daily bar.

Also check our previous BTCUSD analysis here.

Now here’s the key:

If today’s daily bar closes below yesterday’s daily close with volume lower than the previous 2 bars, then it would be considered a potential No Supply bar. And if the volume comes in even lower than the previous 5 bars, the signal becomes much stronger.

So what’s next if this scenario plays out?

Well, if that happens, the next thing we’d be watching for is a Shakeout/Spring-type daily close with volume higher than the prior No Supply bar—basically something similar to the August 31st No Supply bar followed by the September 1st Shakeout/Spring bar.

That would confirm a potential long setup, with stop loss below the Shakeout/Spring bar.

- First target profit (TP) would be around 112,000–114,000.

- If the bearish channel’s upper trendline breaks, then the second TP would be around 118,000–120,000.

- And the third TP could go even higher—maybe even a new Highest High at 130,000? (just saying, lol).

Note: This is not financial advice—just me talking to my charts.

Bearish Scenario:

If today closes above yesterday’s close with low volume (aka No Demand) and then tomorrow prints an Upthrust, BTCUSD could actually take a nasty fall from here.

And hey, don’t say later that I didn’t warn you! A bearish breakout below 107,305 would confirm bearish continuation.

Disclaimer:

This is just me venting my chart feelings, not financial advice fam. If you mortgage your house, sell your car, or pawn your cousin’s goat to go long BTCUSD and the market decides to smack you with a karate kick – don’t come crying. Trade safe, or the market will roast you alive.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.