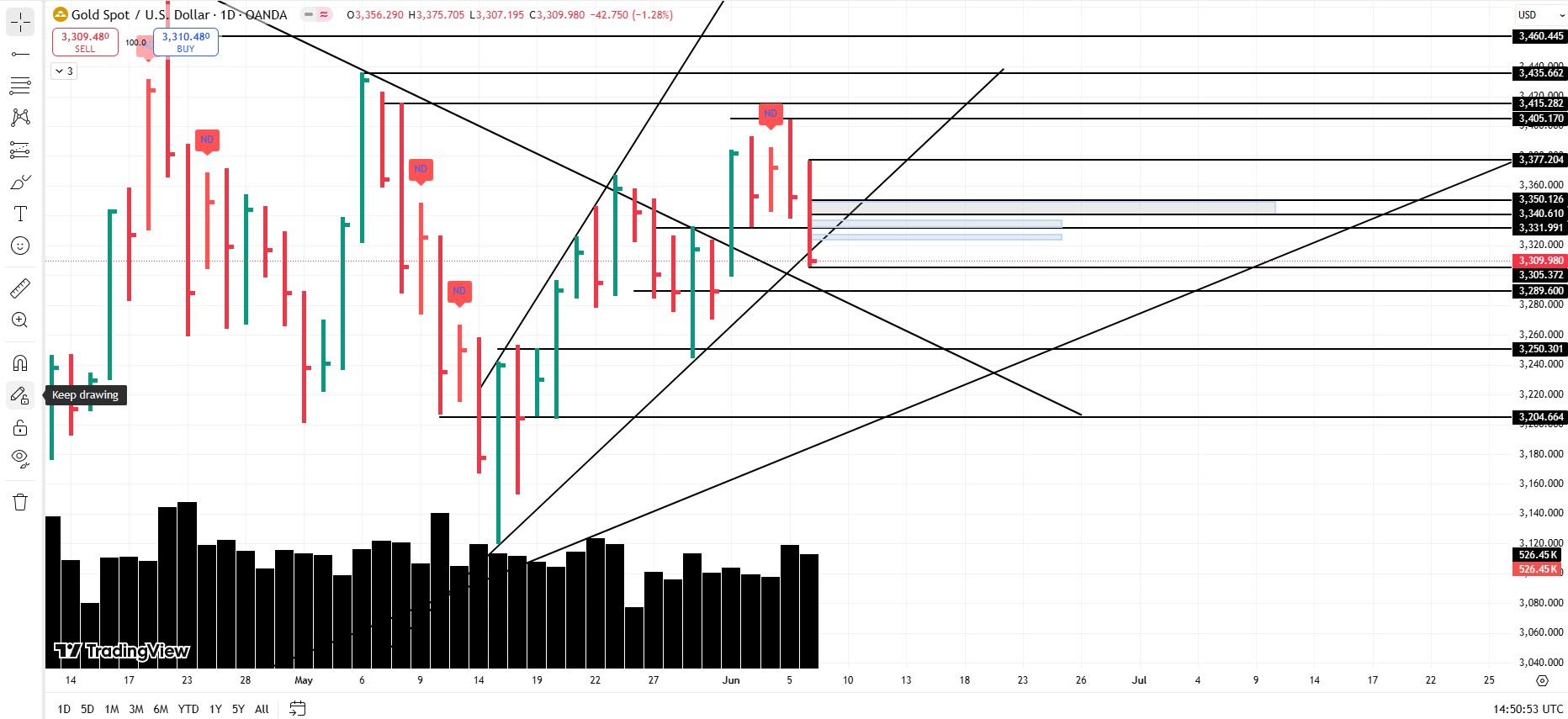

Alright squad, as I mentioned during Thursday’s soul-searching candle session — I was officially on the bear train for Friday. And guess what? Gold obeyed. That 3370–3380 zone I marked? Gold hit 3377 like a rebellious teenager trying to prove a point, then promptly collapsed to 3305 before ending the day and week at 3310. Chef’s kiss to precision.

Now, let’s talk about what Gold might do next week (or what chaos it might unleash instead). Spoiler: I’m still bearish on the daily chart. Monday’s VIP Supply Zone is chilling at 3340–3350. If price bounces up there post-opening, I’ll be lurking like a trader with trust issues, waiting to short.

But wait — small-timeframe heroes, don’t feel left out! There are two mini-Supply Zones too:

- 3323–3328: For those who like quick flings.

- 3331–3338: For those who think they’re dating but it’s really just talking.

Personally? I’m all eyes on 3340–3350 — that’s my high-probability heartbreak hotel for Gold.

But What If Gold Goes Full Drama Queen?

Let’s say Gold decides to flex and break some highs — here’s your “Signs of Strength” (SOS) cheat sheet:

- SOS #1: Break above 3328 (ok, Gold, we see you)

- SOS #2: Break above 3338 (getting cocky now)

- SOS #3: Break above 3350 (this is where bears start sweating)

- Bonus Bullish Drama: Break above 3377 = cue background music and candles. It’s official.

But listen up: if we do hit 3340–3350 on Monday, it’s not all sunshine for bears either. First support hurdle shows up at 3331–3320. Why? Because testing 3340–50 again would mean Gold is trying to sneak back into the previous bullish channel — like an ex who got a haircut and thinks they’ve changed.

So yeah, warning to all: if Gold pulls a “surprise bullish comeback,” don’t say I didn’t warn you.

Can Gold Drop from Here (3310)?

Oh absolutely. In fact, Gold might just pull the plug without even stretching first. Here’s your Demand Zone roadmap to sadness:

- 3290–3280: First comfy nap zone for bulls.

- 3250–3240: A beefy demand zone where bulls might regroup.

- 3205–3188: The legendary weekly demand zone — the “buy it or cry later” zone. If price hits this? Long-term buyers might throw a welcome party with fireworks and fib levels.

Bear Trap Escape Plan:

Let’s say Gold breaks 3328 (SOS level) and heads up — no panic yet. Bears can still hold their ground if price falls back below 3328 and breaks 3320 — that’s your confirmation of a SOW (Sign of Weakness) for Monday and the bear squad gets the green light again.

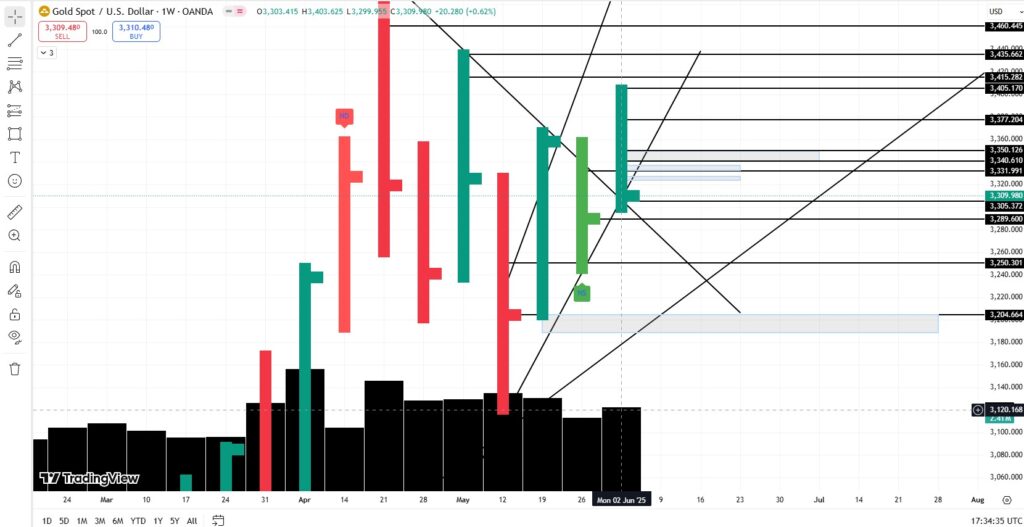

BTW Weekly Analysis:

So, Friday’s weekly candle tried to play it cool and “confirm” that potential No Supply (NS) candle from the week before — but let’s be honest, it pulled more of an Upthrust-in-disguise move. Sure, it closed green, but barely. Like a student who passes with 51% and acts like they topped the class. That teeny-tiny close above the open? Yeah, bears were definitely throwing shade the whole time.

If the market actually plans to go full “long-term bullish”, we’re gonna need a classic VSA Spring pattern — and I don’t mean a polite bounce, I mean a full-on reality-check-then-rebound move. Shake out the weak hands, scare some retail traders, and then launch upwards like Gold just drank a double espresso.

Now here’s the kicker: this weekly close? It’s just barely above last week’s — like, “I swear I’ve changed” energy from an ex. Translation? Gold’s still texting danger at midnight. I won’t be surprised if early next week we see Gold break below 3240 (last week’s low) like it’s testing your patience… only to then dive into that legendary 3205–3188 zone. You know, the “buy it or cry later” area I’ve already eulogized in this post.

And if bulls are serious? Like, really serious? That’s where they’ll show up — suit, tie, fib levels, maybe even a breakout playlist. Because if they don’t defend that zone… well, let’s just say your emotional stop-loss isn’t the only thing that’ll get triggered.

TL;DR:

3340–3350 = Highest-probability daily supply zone. This is where short-term bears will stalk like exes checking your Insta.

3205–3188 = Highest-probability weekly demand zone. If long-term bulls don’t show up here — party’s over.

If Gold smashes through either zone without flinching? Buckle up. Emotional stop-losses might trigger before your SL does.

Final Thoughts & Disclaimer:

Let’s be clear:

- This is NOT financial advice.

- I’m not your guru, your therapist, or your emotionally unavailable Gold whisperer.

- I’m just a sleep-deprived chart stalker with a sarcasm problem.

If you make money — send biryani, memes, or both.

If you blow your account — please don’t DM me crying. I warned you, I even drew levels. The betrayal is between you and the candles.

Remember:

Candlesticks ghost you, volume spills tea, and Gold? Gold’s basically the ex who shows up in your dreams every Mercury retrograde.

Stay sharp, stay skeptical, and keep that risk tighter than your cousin’s budget wedding.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.