Alright folks, the daily candle for August 5, 2025 has officially closed. Here’s what the market showed us:

- Low: 3349

- High: 3392

- Close: 3380

So far, the momentum for XAUUSD aka GOLD remains bullish, but keep in mind — the Major Supply Zone marked in our Weekly Analysis is still intact. Also, if you peeked at the H1 timeframe, Gold has already given a 330-pip drop, so whoever shorted from our marked Supply Zone — don’t forget to send biryani as tribute.

What to Expect on August 6, 2025?

The market has been dancing around in a tight range for the past 2 days. Momentum is bullish, yes — but for Gold to continue further upwards, we need a clean breakout above 3400.

Until that happens, here’s something interesting:

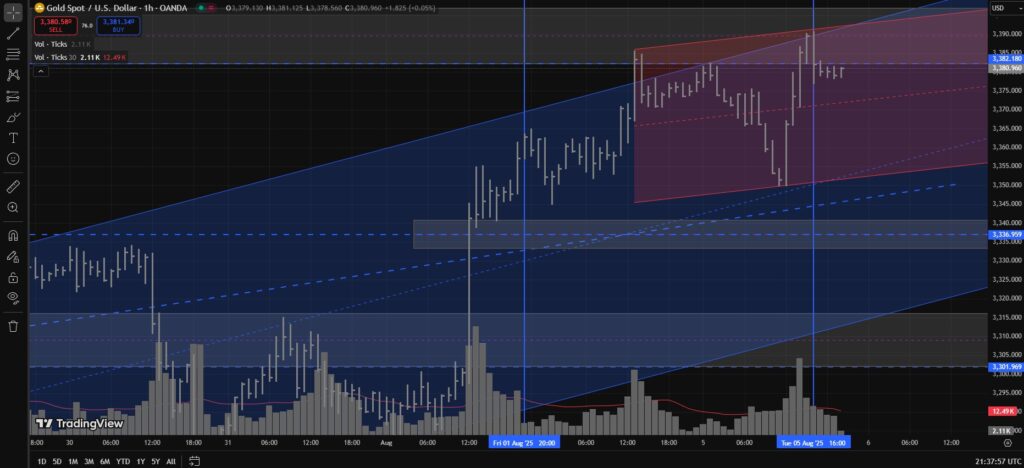

Let’s draw a bullish channel on the H1 chart:

- Start from the August 4, 13:00 UTC High Bar

- Draw to the August 5, 16:00 UTC High

- Then extend down to the August 5, 11:00 UTC Low

This gives us a neat little range within which Gold has been moving for the past couple of days. This is your short-term intraday range for August 6.

Important:

There’s no guarantee price will respect this range, but it’s a solid reference. Anyone planning to enter long or short trades tomorrow should read our weekly analysis and monitor price action inside this defined range.

Breakout Scenarios:

- Bullish Breakout:

If price closes above the upper trendline, the range is invalidated. Expect further upside. - Bearish Breakout:

If price breaks below the lower trendline, again, the range is invalidated, and downside pressure may increase.

In case the upper or lower trendline is broken, do read our Weekly Analysis because it’s highly likely that price may enter our major range and revisit the zones we marked in that analysis — potentially giving us a “Reaction” with those key levels.

But here’s the catch — 3382–3400 is a strong supply zone. As long as it holds, the probability of a bearish breakout from the lower trendline remains higher.

However, if we get a clean breakout above 3400, that’s a game-changer.

Expected Price Levels (If Pattern Repeats):

If Gold moves the same way as it has for the past two days:

- High Expected: 3396–3400

- Low Expected: 3355–3350

Trade Ideas for August 6:

- Buy near 3355–3350

- Target 1: 3365

- Target 2: 3380

- Target 3: Previous Day’s High (3392)

- Sell near 3396–3400

- Target 1: 3380

- Target 2: 3365

- Target 3: Slightly above previous day’s low (around 3352–3351)

Confirmation Tips:

Before you jump into trades like an overconfident ninja, look for confirmations near the LONG and SHORT ZONEs given above:

- For Selling, look for:

- High Volume + Upthrust

- No Demand → Bearish Engulfing

- Two Bar Reversal setups

- For Buying, look for:

- High Volume + Shakeout

- No Supply → Bullish Engulfing

- Two Bar Reversal patterns

TL;DR:

- Gold is still bullish but stuck in a 2-day range.

- Range breakout needed for new moves.

- Buy near 3355–3350, Sell near 3396–3400, but only with confirmation.

- Supply zone (3382–3400) still active — treat it like an ex you’re not over yet.

- Stay alert for breakouts — both upper and lower trendline breaches are invalidation signals.

Disclaimer:

This ain’t financial advice, this is just candle chitchat from someone who stares at charts more than the ceiling fan. If you make money — we party. If you blow your account — send biryani (extra spicy, please). And please… stop falling in love with every green candle like it’s texting you back.

Trade safe. Mark levels. Respect stop-loss like it’s your mom.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.