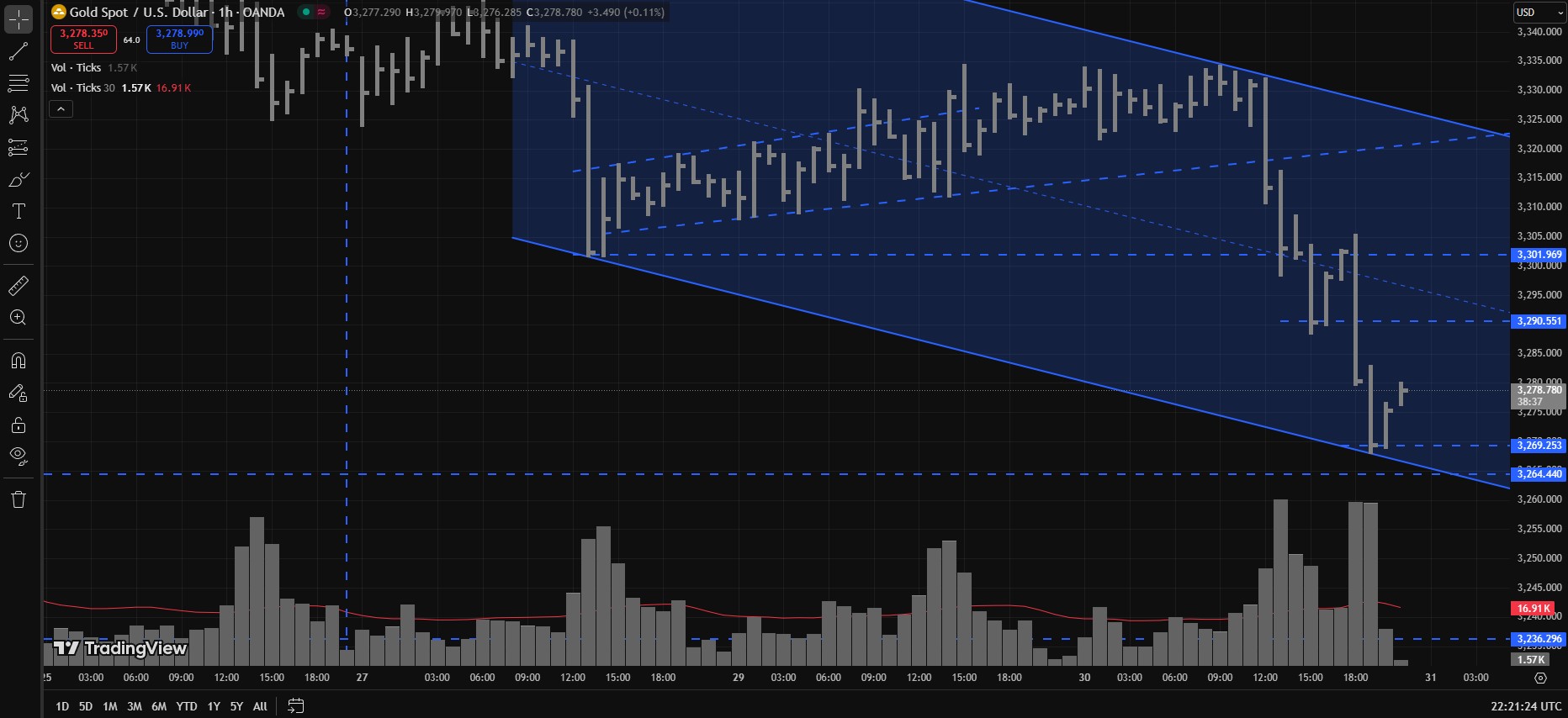

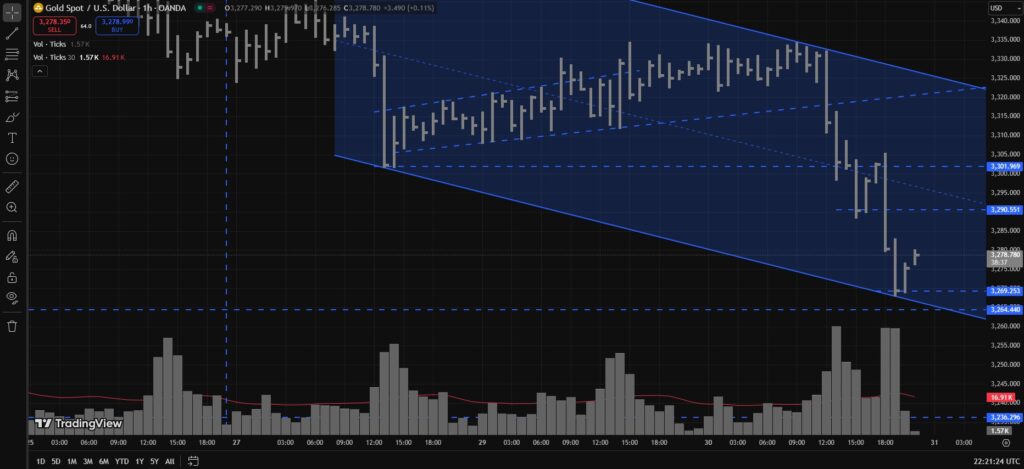

Alright traders, here’s the latest breakdown for XAUUSD ak GOLD market, lets have a look at what happened on July 29 and July 30th, then we will discuss what to expect next.

What Happened on July 29, 2025?

Let’s start with July 29 — a rather boring day in the gold market. There wasn’t much action besides a No Demand candle with a narrow spread. Gold touched a high of 3334, a low of 3307, and closed the day at 3326.

Remember our key resistance at 3331? The market made some fakeouts, slightly poking above it to hit 3334, but failed to break out convincingly. The daily candle closed at 3326, and since the breakout wasn’t real, our previous bearish analysis remained valid even into July 30.

Sure, scalpers may have caught some 150–200 pip trades, but the real move didn’t come — yet.

July 30, 2025 – Gold Dumped Hard!

Now this was the action we were waiting for!

Gold again attempted a breakout above 3331 and tested 3334 — again! But this time, it got slammed. Price dropped heavily all the way to 3268, hitting all our downside targets from the previous analysis.

July 30 Summary:

- High: 3334

- Low: 3268

- Close: 3275 (Just above our 3274 target)

This was a big bearish candle with a wide spread and closing near the low — strong confirmation of selling pressure. No significant buying was observed.

Zone Retest & Structural Insight:

The market tested the same zone as June 27, 2025, and also closed near it.

Now here’s the deal for July 31, 2025:

If Gold wants to reverse or go into a range, 3264 must hold. As long as there’s no bearish breakdown of 3264 by UTC 05:00, there’s a chance for a sideways range between:

- 3290–3301 (upper boundary)

- 3264–3269 (lower boundary)

If this happens, no fresh breakout = no new trend = range play.

Bearish Scenarios:

If that support doesn’t hold, watch out — Gold could drop further to:

- 3236-3230

- 3207–3200

Possible Intraday Setup for August 1, 2025 (Friday):

If Gold ranges within 3264–3301 and climbs back toward 3301 by Friday between UTC 07:00–12:00, then:

- Watch 3301 closely for rejection

- A fake breakout up to 3305–3306 followed by a close below 3301 could be a prime short entry

Potential Targets for this short setup:

- 3290

- 3275

- 3269–3264

- 3250

- 3240–3230

…and beyond if bearish momentum continues.

What’s Next?

Since heavy bearish targets were hit on July 30, I plan to take a rest on July 31 — no trades planned. But if you see something nice and juicy, feel free to dive in at your own risk of course — just stick to the roadmap above.

Let’s see how the market closes today to decide what to do for August 1.

TL;DR:

- July 29 = boring, fakeouts near 3331, daily close at 3326.

- July 30 = massive bearish move, all downside targets hit.

- July 31 = stay cautious; if 3264 holds, expect range between 3264–3301.

- If 3264 breaks, next levels are 3232 > 3207–3200.

- Friday (Aug 1): If market hits 3301 again and rejects, look for a strong sell.

- No trade plan today — only observe and reassess.

Disclaimer:

This isn’t financial advice — it’s just a trader talking to the candles and occasionally yelling at support zones that betray him.

If you profit, it’s your skill. If you lose, it’s the market makers.

If both happen, blame the cousin who keeps sending “100% signal” screenshots from Telegram. Stay sharp, Legends.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.