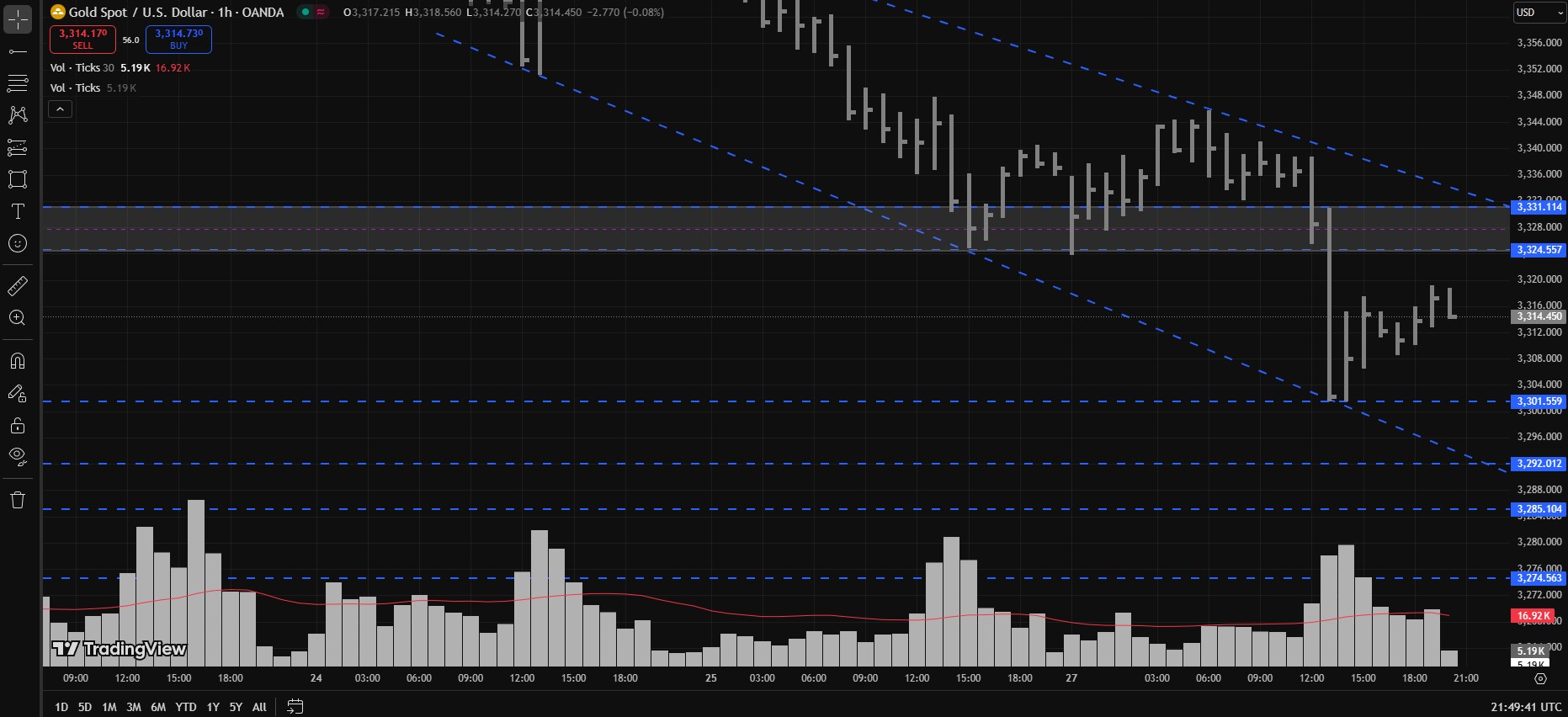

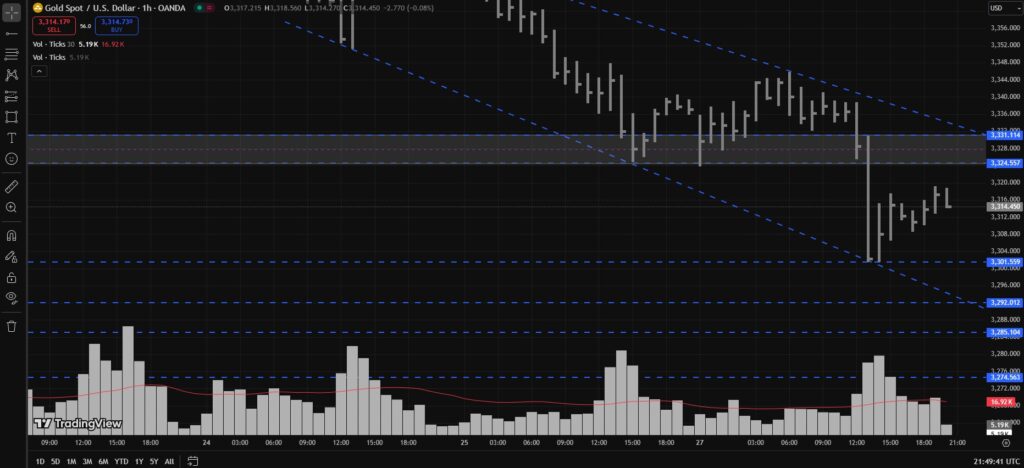

Alright traders, as I mentioned in the previous intraday analysis — 3308 was the key. As long as there was no bearish breakdown, we were looking for buys. I also gave you the key levels to watch, and guess what? From 3324, the market jumped nearly 210 pips.

Our first target was around 3340, which was hit (and slightly exceeded) when gold reached around 3345, before pulling back.

Breakdown & Bounce Recap

After that bullish ride, Gold broke the 3308 support zone and touched 3301, but then immediately bounced back up to around 3317 — a sharp 170-pip move. Classic intraday action. The takeaway? Grab your 100–150 pips, lock the profits, and exit gracefully.

Monday’s Candle Summary

- High: 3345

- Low: 3301

- Close: 3314

Now that Monday’s daily candle is closed, it’s time to look ahead at what Tuesday might bring. Let’s break it down.

Key Structural Update

In the previous analysis (July 28th, 2025), I explained clearly:

- 3308 was the key level.

- If it breaks bearishly, structure shifts.

- And if Gold still wants to go bullish despite that breakdown, we needed a daily close above 3324 to regain strength.

What actually happened? Gold closed at 3314, not above 3324 — so the bias for Tuesday, July 29, is bearish, as long as the 3324–3331 resistance zone remains intact.

We’ve also got to remember:

- Last week closed with an Upthrust, a classic sign of weakness.

- So, while that 3324–3331 area holds as resistance, we stick with the trend — which is currently bearish.

Supply Zones to Watch (Tuesday, July 29, 2025)

- 3317–3320 — First reaction zone

- 3324–3331 — Ideal Supply Zone where a heavy drop could be triggered

Bonus Tip: Time Matters

If Gold tests the 3324–3331 zone during UTC 02:00 to 05:00, it could be a very high-probability short entry zone.

Bearish Targets (If rejection happens):

- Target 1: 3308

- Target 2: 3301

- Target 3: 3292

- Target 4: 3285–3280

- Target 5: 3274

- And more, if momentum continues…

What If Market Goes Bullish?

If Gold breaks above 3324–3331, the bias immediately flips to bullish, and we’ll look for long entries instead. Until that happens — we stay bearish and follow the momentum.

TL;DR:

- 3308 broke down, so bearish bias now.

- Daily close was 3314, not strong enough for a bullish flip.

- Watch 3324–3331 zone for potential rejection.

- Bearish Targets: 3308 > 3301 > 3292 > 3280 > 3274.

- Bullish breakout above 3331 invalidates this outlook and turns bias into bullish.

Disclaimer:

This is not financial advice — this is candle gossip dressed up as analysis.

If you win, thank the trend. If you lose, blame the liquidity sweep — or that one cousin who always sends you signals at the wrong time.

Trade smart. Use a stop-loss.

And remember: Not every red candle is your enemy — but definitely not your ex either. Happy Trading, Legend!

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.