Alright folks, gather ’round because we’ve got some post-Sunday-night chart gossip hotter than your chai on a summer night. If you read last week’s analysis (which you totally did), then congrats — you saw Monday’s bounce coming before it even left the bed.

Let’s rewind.

Monday’s Bounce-a-Palooza

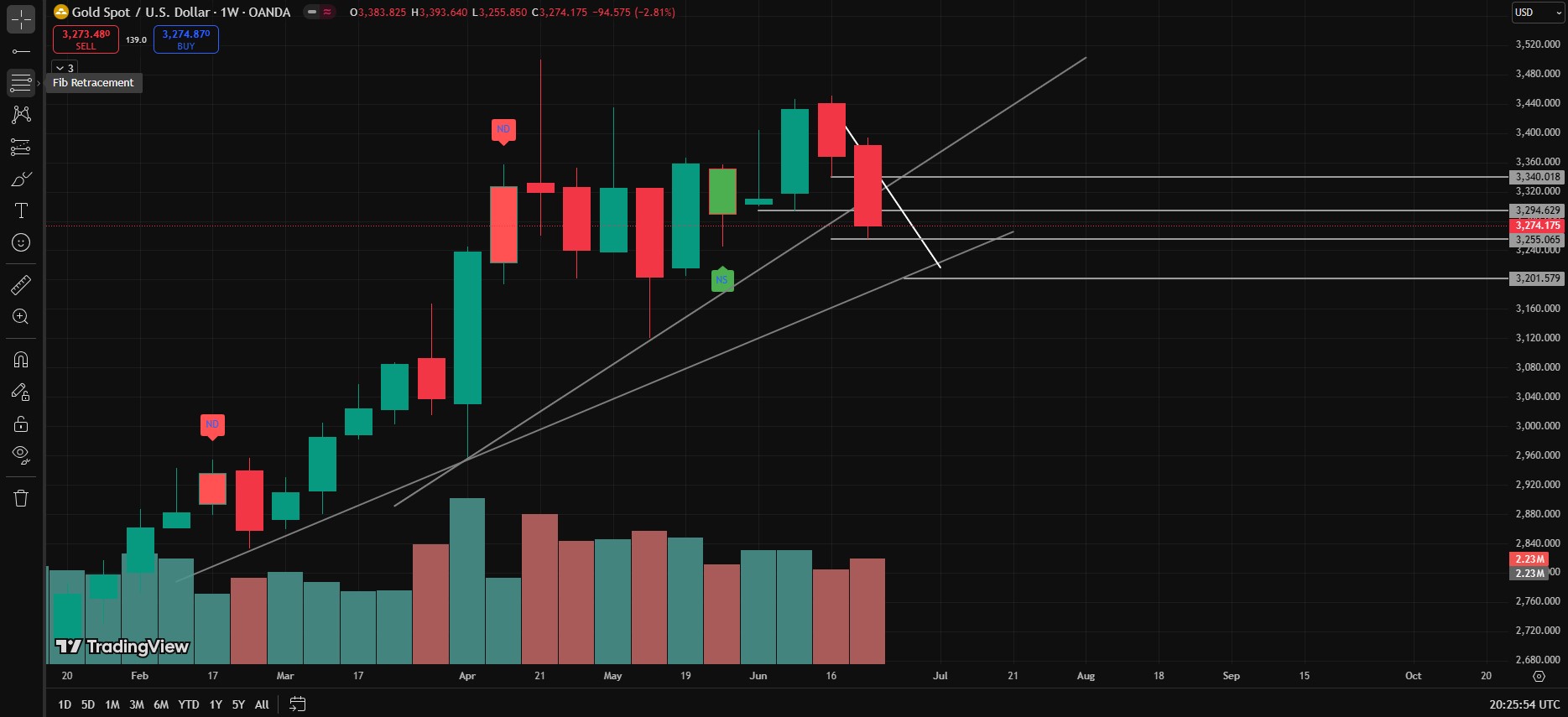

Remember how I told you to keep your third eye on the 3358–3352 zone? Well, guess what? Gold tiptoed into that area, gave it a little smooch, and BOOM — jumped to 3394 like it just remembered its ex was watching.

But wait, the drama didn’t stop there.

From 3394, Gold tripped over its own ego and took a not-so-graceful dive. Landed briefly at the 3340 zone — showed a little respect, like a rebellious teen nodding at grandma — then ghosted that support too and fell into the arms of our heroic savior: 3300.

Yes. The same 3300 I begged you to watch in the last episode. Turns out, it’s the lifeguard of this soap opera.

VSA Alert + Bearish Whisperings

Now, here’s where things get spicy. Gold bounced from 3300 and hit 3350, which was technically a Lower High — but plot twist — it screamed textbook VSA entry. You know, that juicy hidden demand candle that seduces you into a buy right before the breakup?

But 3340–3350? That zone turned into your classic SBR (Support Becomes Ruthless Resistance) and shoved the price right back down like a desi mom catching you skipping tuition.

Next stop? 3255.

Gold did eventually settle down a bit and closed the week at 3274 — not a total disaster, but definitely grounded for the weekend.

What’s Next? Supply Zones or a Fresh Breakdown?

Let’s talk game plan for the new week:

Bearish Supply Zones (aka Red Light Areas) – H1 Timeframe:

- 3294–3300: First SBR zone. Expect some rejection here if Gold dares to climb back up.

- 3318–3334: This one’s the moody aunt — lots of supply and doesn’t like surprises.

- 3340: The infamous Order Block + last week’s resistance. Enter here if you like playing with fire.

Weekly Fibs & Holy Demand Levels

Now for the fib freaks:

- Weekly fib says 3324–3340 is your ideal sell zone for those institutional rejections.

- If the market takes a nosedive, don’t freak. I’m personally setting up a welcome party at 3200–3190 — the ultimate demand zone and potential bounce palace. Whether Gold wants to launch from here or just loiter around, expect something to happen.

TL;DR for the Click-Happy Traders:

- Next possible short areas: 3294–3300, 3318–3334, and 3340.

- If Gold tanks, 3200–3190 is where the bulls might finally wake up (with or without coffee).

- Watch for war headlines — they’ve got more influence on Gold than any indicator you own.

Final Thoughts (and Warnings):

Gold’s still dancing in a bearish mood on lower timeframes. But with zones mapped and volatility promised, you’ve got all the tools. Use them wisely — or just blame your indicators later.

Disclaimer:

This is not financial advice — it’s gold gossip written by someone who’s 90% caffeine and 10% regret. If you make money, send me biryani. If you blow your account, don’t come crying — I warned you about those lot sizes. Always use a stop-loss. And no, every bullish candle isn’t your soulmate — some of them are red flags in disguise.

Now go forth and trade — responsibly (ish).

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.