Alrighty then — let me spill the chai on what Gold (a.k.a. XAUUSD drama queen) has been up to today.

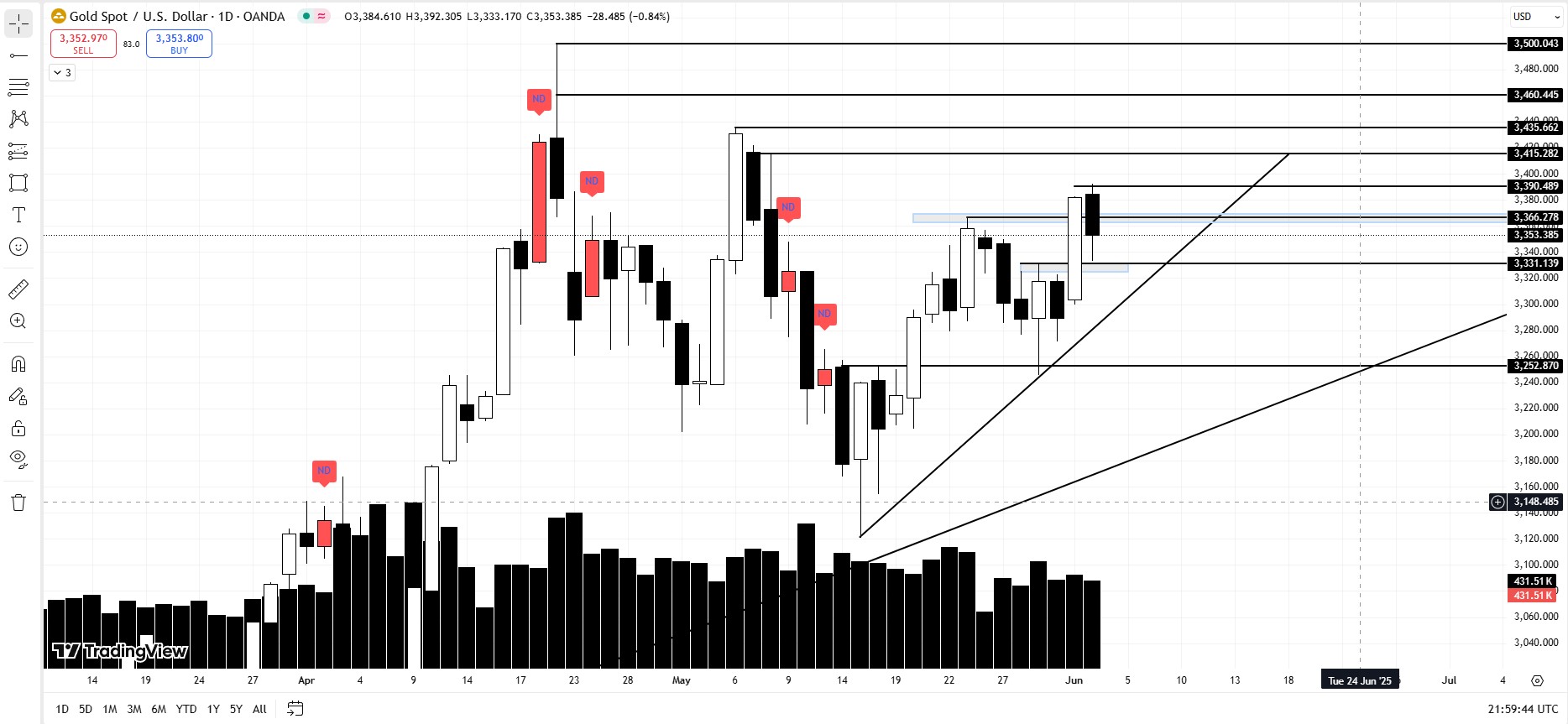

Gold took a little nosedive from 3390 — probably got dizzy from the altitude — and flirted dangerously close to our VIP level at 3331. Remember that zone we marked as “very important” in the last episode? Yeah, that one. Turns out, buyers were hiding in the bushes around 3333 and jumped in like it was a Black Friday sale. Gold rebounded and gave us a closing candle at 3353. Cute move, Gold. Real cute.

Bullish Until Proven Otherwise:

My bias is still bullish. I’m not ready to betray the golden god just yet.

Level 3331 remains the bouncer at the club — unless we get a proper bearish breakout below it, I’m sticking to the long side.

But… if Gold throws a tantrum and does break 3331, and then even breaks below 3299, then I’ll stop playing favorites and start eyeing bearish setups. Until then, bears can keep hitting snooze.

Also, anything between 3331 and 3299? That’s the “No Go” zone for me. Like that weird cousin at family gatherings — I’d rather not deal with it.

Danger Zones Ahead:

Let’s talk traps — err, I mean supply zones.

Before Gold (XAUUSD) tries to break below 3331, there’s a nasty little supply trap waiting between 3363–3368. Be careful, that’s a setup for heartbreak.

For our bullish hopefuls, here’s the upcoming obstacle course:

- 🟥 3366: Supply Area just between 3363-3368

- 🟥 3390: Resistance Level

- 🟥 3415: Supply Zone

- 🟥 3435: Supply Zone

- 🟥 3460: Supply Zone

- 🟥 And of course, 3500 — the infamous level everyone’s grandma is talking about.

The “If Everything Falls Apart” Scenario:

Let’s imagine Gold goes full chaos mode — breaks 3331, then 3299… If that happens, then we go back to the script from the last episode where 3160 becomes our dreamland for long-term buyers. But hey — if Gold decides to flirt around 3304, a brave soul might risk a sneaky long trade there with a teeny-tiny stop loss. Basically, it’s like poking a sleeping dragon with a toothpick — risky, but if it works, you feel like a legend.

Want to revisit that glorious first analysis? Here you go, Sherlock:

👉 First Analysis Link (Drama, False Breakouts & the 3160 Fairyland)

Final Note (aka My Legal Exit Strategy – Disclaimer):

Look folks, this isn’t financial advice. I’m not your guru, therapist, or portfolio manager. I’m just ranting into the void for educational vibes.

If you make money — cool, buy me biryani.

If you lose your shirt — well, I warned you. Don’t come throwing your Metatrader at me.

Trade smart, don’t fall in love with candles (they cheat), and remember: Gold has more mood swings than a Netflix teen drama.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.