Alright gold diggers (of the trading variety), gather ‘round your charts — because Gold’s got more drama than your cousin’s wedding WhatsApp group.

It’s Sunday, July 27th, and the candles are cooled, the volume is in, and the market is prepping its outfit for Monday’s grand weekly open (July 28th). So naturally, we’ve got to decode whether Gold is planning to swipe up, swipe down — or just ghost us again.

Last Week’s Recap: “The Upthrust That Ghosted”

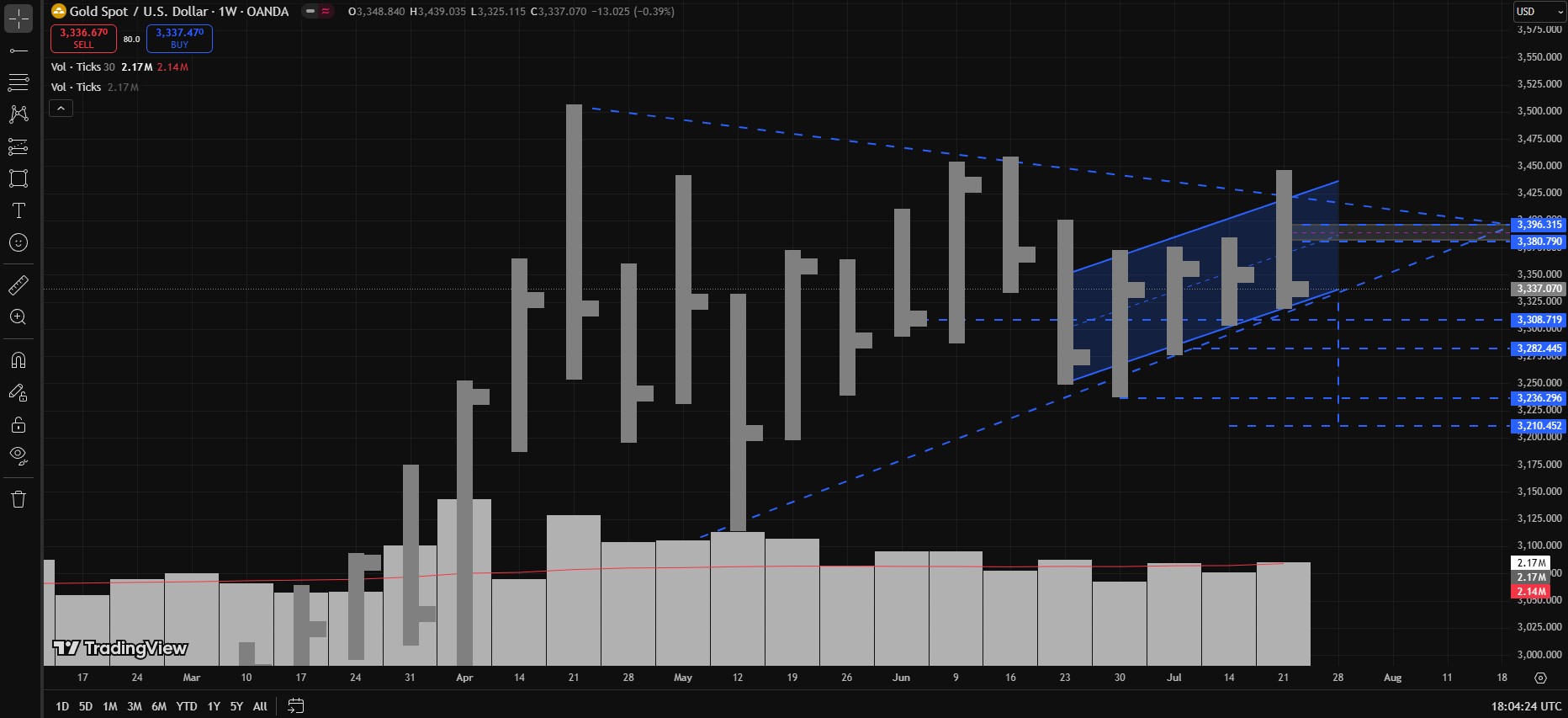

Let’s talk about the main character energy candle from last week (ending July 25th):

- High: 3440

- Low: 3324

- Close: 3337

- Type: UPTHRUST (yup, the fake breakout kind)

- Previous week? Narrow body, low drama — just a candle trying to “work on itself.”

We were all excited when Gold finally broke 3370 like it was breaking up with its toxic resistance. It even flirted with 3440! But plot twist: that candle had commitment issues. Closed down at 3337. Gold did what Gold does — climbed the stage, struck a pose, and then slipped on its own bullish heels.

Structure Breakdown: Bullish Channel Still Holding… For Now

- Since June 30th, Gold has been strutting up a bullish channel like it’s on a catwalk.

- Guess what? No bearish break of any Higher Low since then. Not even one.

- The lower trendline (from May 15th) on the daily chart is still intact — like that one friend who never flakes on plans.

- Friday’s candle showed some buying pressure… but the volume? Potential No Supply.

Key Zone Watchlist:

| Level | Why It Matters |

|---|---|

| 3320–3315 | Daily trendline support from May 15th |

| 3308 | Big juicy CHOCH zone — break this, and we might start crying |

| 3285–3280 | Potential “Spring” area (if we go full VSA mode) |

| 3210–3200 | If the Upthrust decides to go full heartbreak |

| 3380–3395 | Possible rejection zone aka FIB Level — romantic, dramatic, possibly traumatic |

Possible Scenarios (a.k.a. Choose Your Own Candle Adventure):

Bearish Breakout: “The Downstairs Neighbor”

If that Upthrust from last week actually meant something (for once), and Gold breaks 3308, we could be looking at:

- A CHOCH moment.

- A sweep of 3285–3280.

- A deep dive to 3210–3200.

- Cue the sad violin.

Bullish Rebound: “The Spring Awakens”

If Gold wants to play cute, it might:

- Sweep below 3308 to trap bears,

- Tap 3285-ish for liquidity,

- And then shoot back up above 3324 like, “Lol jk, I’m bullish again.”

In that case, your favorite markup phase could return, with targets like:

- 3380

- 3395

- 3415

- And if things get spicy — 3440 breakout, for real this time (no promises).

Fake Bounce from 3337: “The Plot Twist”

If the market pulls a fast one and bounces directly from 3337, don’t get too cozy.

- The 3380–3395 area is the next important FIB level.

- That’s where Gold might pause dramatically, stare into the void, and… fall right back to 3337. Or worse.

TL;DR:

- Upthrust on the Weekly = Possible sign of Smart Money unloading.

- As long as 3308 holds, structure is still technically bullish.

- Below 3308 = CHOCH confirmed = Look out below!

- 3380–3395 = Key FIB Level, potential rejection zone.

- Watch for bounce from 3308–3280 if you’re into wild rebounds.

- Until breakout/breakdown — play the range, not your emotions.

Disclaimer:

This is not financial advice — it’s candle gossip dressed up as analysis. If you make money off it, buy me coffee.

If you blow your account, well… maybe don’t bet your rent on a fake breakout with trust issues.

“Gold doesn’t owe you an explanation. But you owe your account a stop-loss.”

Trade safe. Chart hard. And please, for the love of structure — stop chasing green candles like they’re true love.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.