XAUUSD Weekly Outlook – Market Structure, Key Levels & Trading Plan

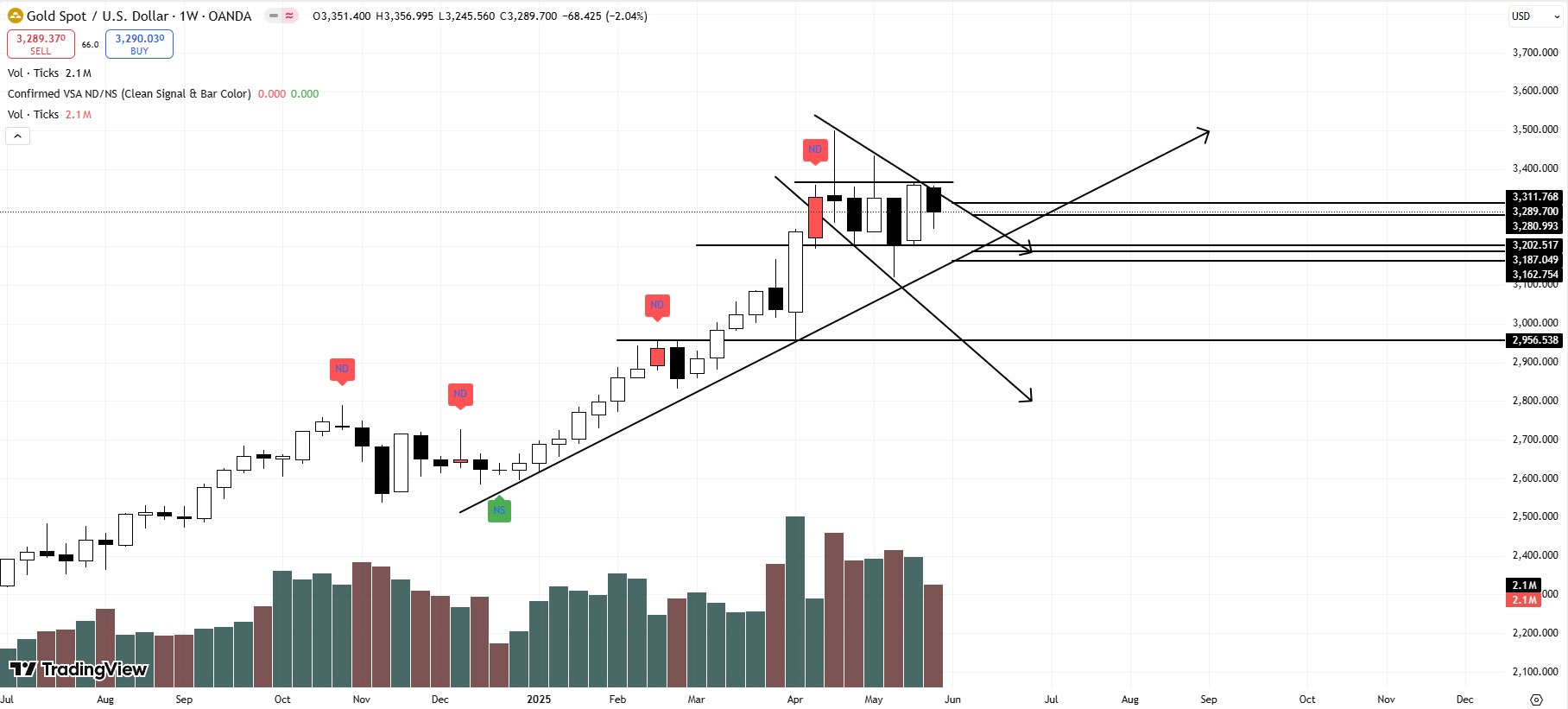

Gold (XAUUSD) has been under my close observation, especially since it made a significant high around the 3500 level in April 2025. Interestingly, that high has not been broken up to the end of May 2025, and since then, the market has started moving within a bearish channel.

Last week’s candle, which closed on Friday, attempted a bullish breakout above the upper trendline of this bearish channel. However, due to low volume, it turned out to be a false breakout, and the price eventually retraced and closed at 3289.

Now, as the market is about to open in a few hours, here’s my current stance:

Until Gold breaks above the upper trendline of the bearish channel, which lies roughly between 3311 and 3315, I will continue to treat this market as bearish and categorize it under Sign of Weakness (SOW) in Volume Spread Analysis (VSA).

However, if price manages to break out above the 3311–3315 zone on high volume and closes above it, I will take it as a Sign of Strength (SOS), and that would flip my bias to bullish.

Until that breakout happens, my overall market bias remains bearish.

Potential Bearish Targets:

The first major demand zone/support area lies around the 3200 level. However, my personal expectation is that price might drop even further to 3160, where a significant bullish trendline support lies — this trendline has been intact and forms the base of the overall bullish structure.

That 3160 area would be my ideal level to drop down to lower timeframes and start looking for buy setups for a long-term position.

If the price doesn’t reach 3160 this week, then I’ll watch for a potential bounce around 3180 next week, as the same bullish trendline would shift slightly upward in time.

Trading Plan Scenarios:

- Bullish Scenario:

A high-volume breakout and close above 3311–3315 zone will be a confirmation of strength. In that case, I’ll look for buying opportunities. - Bearish Scenario:

As long as the market remains below 3311–3315, I treat this as a retracement in a broader bullish structure, and prefer a drop toward 3160, followed by a buy setup. - Sideways Scenario:

If the market trades sideways between 3311 and 3200 for the whole week, I won’t plan any long-term entries. I will wait for next week to reassess, ideally watching for long entries from around 3185/90 or a breakout above 3280/85.

Final Note:

My outlook suggests that the market is still in a broader bullish trend, but this current drop seems like a retracement phase. As such, 3160 appears to be a key level for this week. If not touched, then 3180 could be in focus next week.

These are my personal trading views based on market structure, VSA, and price action — not financial advice. Please do your own research. The market can humble anyone, and I’m not responsible for any losses based on this write-up.

Disclaimer:

Once again I am telling you! This is not financial advice, okay? If Gold drops and your account takes a nosedive with it — I take zero responsibility for that!

This is just a part of my personal trading journal. If you take it seriously and the market slaps you around… well, that’s on you, my friend 😄

If you make a profit, don’t forget to send some sweets 🍬, and if you take a loss… please don’t block me, alright? 😂

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.