Alright you shiny metal lovers, Monday’s candle has officially closed – and let me tell you, it wasn’t just any close. Gold (a.k.a. XAUUSD, a.k.a. King Drama) decided to stir the pot and serve up some hot bullish momentum with a side of confusion.

Here’s what Monday cooked up:

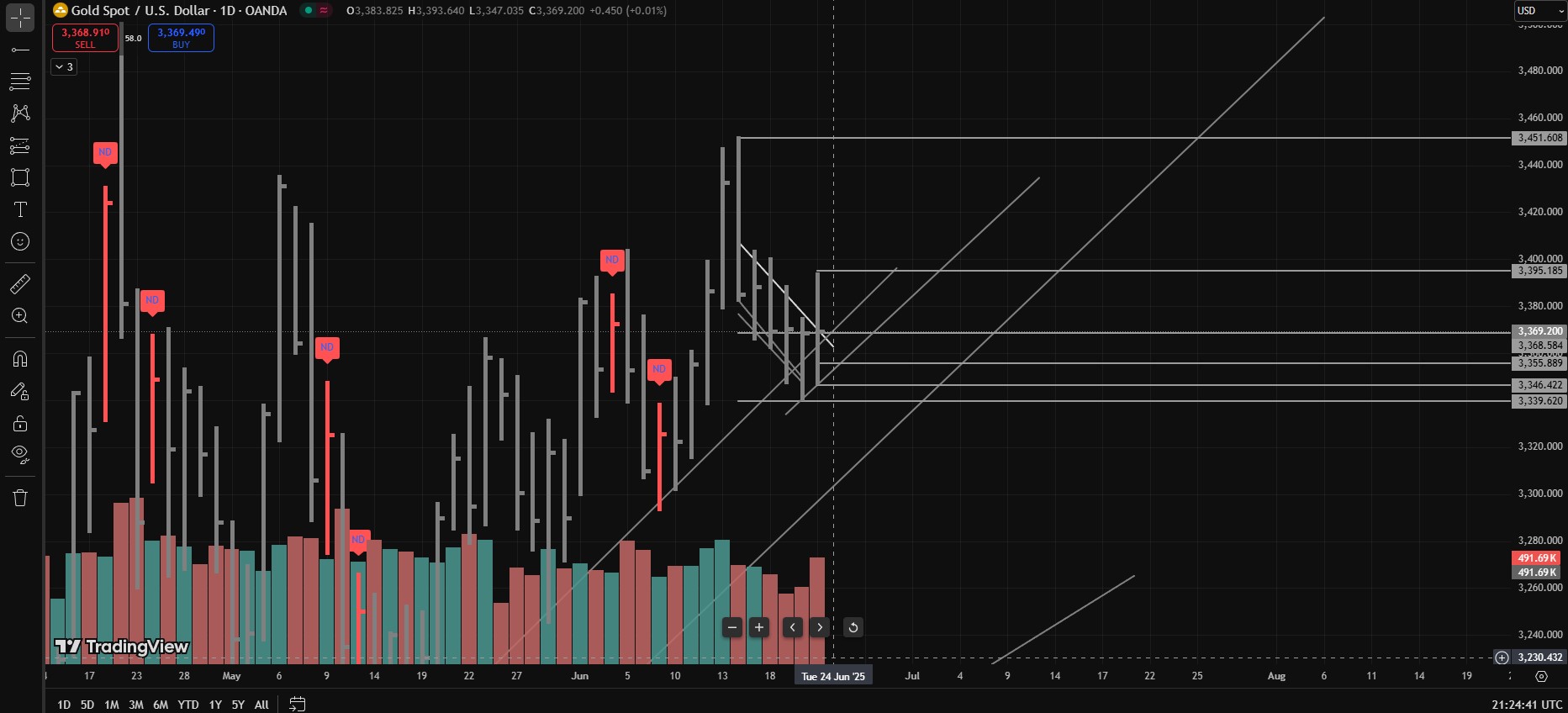

Low: 3345

High: 3394

Close: 3369

Now yes, yes — I hear you yelling, “But the daily candle was a down bar!” And you’re not wrong. But guess what? Momentum was still bullish. Why? Because the previous Lower High is now ancient history and the upper trendline of the bearish channel has been shattered like your hopes of getting rich on meme coins. That’s called a structure shift on the hourly chart, folks.

Bullish Until Proven Broke

As long as 3345-3340 doesn’t break down like my diet plans on weekends, Gold is bullish in my books. This zone is now your no-go zone for shorts. Stay above = think long.

Remember My Prophecy from the Last Analysis?

I talked about the 3358–3352 daily demand zone for Monday. And BOOM — Gold served us a climactic buffet right at 3352. Beautiful stuff. A textbook Volume Spread Analysis (VSA) setup.

Also, fun fact: Gold gapped up to 3383 at Monday’s open. Likely because Uncle Sam decided to drop a few fireworks on Iranian nuclear sites. And 3383 wasn’t just any number — it was right above the old LH and our dear bearish channel. So yes, technically speaking, that was a breakout.

Then what?

Gold dipped to test our zone — landed beautifully at 3352, printed a juicy Climactic Action bar on the hourly, gave us an Automatic Rally, then did a little fakeout (Spring!) at 3345 to shake off weak hands, and closed back above. Peak drama. Loved it.

Then it ran to 3394 like nothing happened.

Also, remember how Friday’s candle was a sneaky little thing? It was a down-close candle, but I called it out for having hidden demand (long lower wick + higher volume than the previous NS candidate). It whispered, “I’m bearish… but only pretending.” And guess what? Monday proved me right. Vindication tastes like samosas.

Oh and 3340? That weekly level we marked? Yeah, Gold didn’t even bother touching it. Just flirted near 3345 and left.

So What’s the Plan for Tuesday?

Since the breakout happened and Monday gave us a shiny new Higher Low at 3345 and High at 3394, Tuesday is set to continue the bullish gossip train. We’re now stalking long entries only — unless 3345-3340 decides to betray us and break down. Until then: bullish bias.

Ideal Bounce Zones:

Between 3370–3364. My Fibonacci tools are pointing at it like it’s the chosen one. Aside from that, 3355-3350 is another important level and finally 3345-3340 is the last line of defense for buyers on Tuesday.

“But Khurram bhai, how do I enter?”

Ah, my impatient grasshopper — we don’t just dive in blindly. This isn’t Tinder. We wait. We look for VSA confirmations around our level:

- Climactic Action

- AR

- Spring

- No Demand

- No Supply

- Two Bar Reversal

- Upthrust

…and the usual soap opera cast of volume-based drama.

Can Gold bounce from the current level?

Absolutely. It’s Gold — it does what it wants, when it wants. But we wait for VSA signals before joining the party.

Final Words from the Sleep-Deprived Chart Whisperer:

That’s the analysis for today. If it helped you — fantastic. If not — blame your broker, not me.

TL;DR – XAUUSD Tuesday Forecast: Breakout or Fakeout?

- Monday Recap: Gold ranged from 3345 to 3394, closing at 3369. Despite being a down-close candle, momentum remains bullish due to a confirmed structure shift (hourly breakout of bearish channel + higher low).

- Key Zones to Watch:

- 🔹 3370–3364 – Fibonacci-backed ideal bounce zone

- 🔹 3355–3350 – Secondary support zone

- 🔹 3345-3340 – Final line of defense for bulls

- Volume Spread Analysis (VSA):

Monday printed a Climactic Action bar, an AR, and a Spring off 3345 — a clean shakeout and rally. Friday’s hidden demand setup played out perfectly. - Entry Strategy:

No impulsive buys — wait for VSA confirmations like Spring, No Supply, or Two-Bar Reversals near the bounce zones. - Bias:

Bullish unless 3345-3340 breaks. All long setups are valid above that line.

Disclaimer:

This is NOT financial advice. This is a caffeine-fueled chart rant by someone who has seen too many stop-losses hit in life.

If you get rich, send samosas. If you blow your account, maybe lower your lot size next time.

And PLEASE… don’t fall in love with every green candle. Most of them are just toxic.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.