Alright folks, so here’s the scene. XAUUSD aka GOLD gave us the Weekly Closing yesterday, and today I thought – why not do a full post-mortem and see what this crazy metal might do in the coming week?

Weekly Recap

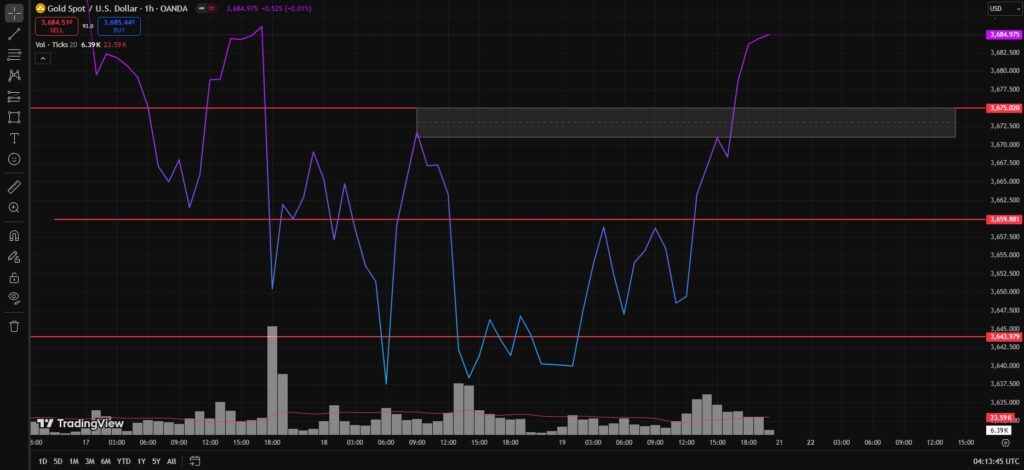

The previous week (Sept 15–19, 2025) Gold made a Low around 3626, a High around 3707, and finally closed at 3684 with Ultra High Volume (UHV) above the MA30 on the OANDA chart.

Compared to the week before:

- On ICMarkets, volume was also above MA30 but slightly lower than the prior week.

- On OANDA, volume was similar, but the spread was much narrower.

Daily Timeframe Breakdown

On Friday, Sept 19, Gold printed a very strong UP bar, closing near the high with low effort volume. Low was 3632, High was 3685, and Daily Closed at 3684.

This was a classic Low Effort vs High Result (EvR) scenario, which basically means:

- No real resistance,

- Supply wasn’t strong,

- Demand easily pushed the price upward with minimal effort.

In other words, the supply that came in on Sept 17 (which we had actually expected on Sept 16) looks to have been absorbed by demand. That suggests Gold may be gearing up for the next big leg higher – 4000 anyone? (just kidding… or maybe not!)

As long as 3632-3626 holds on the Daily timeframe, the bias remains bullish and the structure stays bullish.

H4 Timeframe Analysis

- First Support / Demand Zone: 3675-3672 (good for aggressive traders with wide stops).

- Conservative Entry Zone: 3660 (a clean RBS level).

- Additional supports: 3644 and finally 3632–3626.

For a bullish breakout above 3707, ideally Gold should launch either from around 3660 or after a dip into 3644 before heading higher. A bounce from these zones could set up the breakout move.

H1 Timeframe & Wyckoff Logic

Zooming into the H1 chart, Wyckoff logic shows a “Jump the Creek” at the 3672 breakout, after which Gold moved to 3685 and closed at 3684. Now a retest of the 3675–3672 zone is likely. If that holds, the Markup Phase could officially begin.

TLDR:

- Bias is bullish as long as 3632-3626 intact.

- Support levels aka Demand Zones: 3675-3672 > 3660 > 3644 > 3632–3626.

- Break above 3707 could take us much higher.

- Wyckoff’s Jump the Creek already in play on H1 Timeframe, now awaiting retest before markup.

- As long as 3632-3626 holds, GOLD stays bullish.

Disclaimer:

This is just me venting my chart feelings, not financial advice fam. If you mortgage your house, sell your car, or pawn your cousin’s goat to go long GOLD and the market decides to smack you with a karate kick – don’t come crying. Trade safe, or the market will roast you alive.

Discover more from MAMKTRADERS.COM

Subscribe to get the latest posts sent to your email.